Simple Budget Tips Everyone Can Follow for Financial Success

Simple Budget Tips Everyone Can Follow for Financial Success

Simple Budget Tips Everyone Can Follow for Financial Success

Budgeting is often seen as a daunting task, but it doesn't have to be. With just a few simple tips, anyone can get their finances in order. Have you ever wondered why sticking to a budget can seem so tricky? Most people struggle with it because they lack clear strategies.

In this post, we’ll break down accessible budgeting techniques you can follow right away. You’ll learn how to identify your needs versus wants, utilize effective tools, and set realistic spending goals. No prior experience needed; these tips are designed for everyone, regardless of their financial background.

Take control of your spending and watch your savings grow. Let's explore these straightforward methods that can turn your financial dreams into a reality.

Understand Your Income

Knowing your total income is essential for creating a realistic budget. Without a clear understanding of how much money you bring in, it's tough to make informed spending decisions. Let’s break down some key aspects of understanding your income more thoroughly.

Calculate Your After-Tax Income

To get a clearer picture of your finances, start by calculating your after-tax income. This is the amount you actually take home after all deductions like federal, state, and local taxes. Understanding this figure helps you budget effectively while knowing exactly what you have to work with each month.

To determine your after-tax income from paychecks, follow these steps:

-

Identify Your Gross Pay: This is your total pay before any deductions. It might appear on your pay stub as “gross earnings”.

-

Use a Paycheck Calculator: There are various tools online that can simplify this calculation. For example, try the Paycheck Calculator. Just enter your gross pay, frequency of pay, and state to receive a detailed breakdown.

-

Subtract Deductions: Your paycheck will typically include deductions for federal and state taxes, Social Security, Medicare, and possibly 401(k) contributions.

-

Review Your Pay Stub: This document shows all deductions and provides a clear view of your net income.

These steps will help you arrive at a solid understanding of your actual income, allowing for smarter budgeting.

Identify All Income Sources

Once you have calculated your after-tax income, the next step is to identify all your income sources. Having various streams of income can provide you more financial stability and adaptability. Here are some common sources to consider:

- Earned Income: This includes wages or salary from your job.

- Side Jobs: Freelancing or part-time work can supplement your primary income.

- Passive Income: Consider income from investments, such as dividends or interest from savings. Explore more options in this great article on 25 Passive Income Ideas.

- Rental Income: If you own property, renting it out can generate steady income.

- Capital Gains: Profits made from selling investments for more than you paid for them.

- Royalties: Earnings from creative work such as books, music, or patent rights.

Understanding the diversity of your income prevents reliance on one source. For a comprehensive look at different income streams, check out the 7 Different Types of Income Streams.

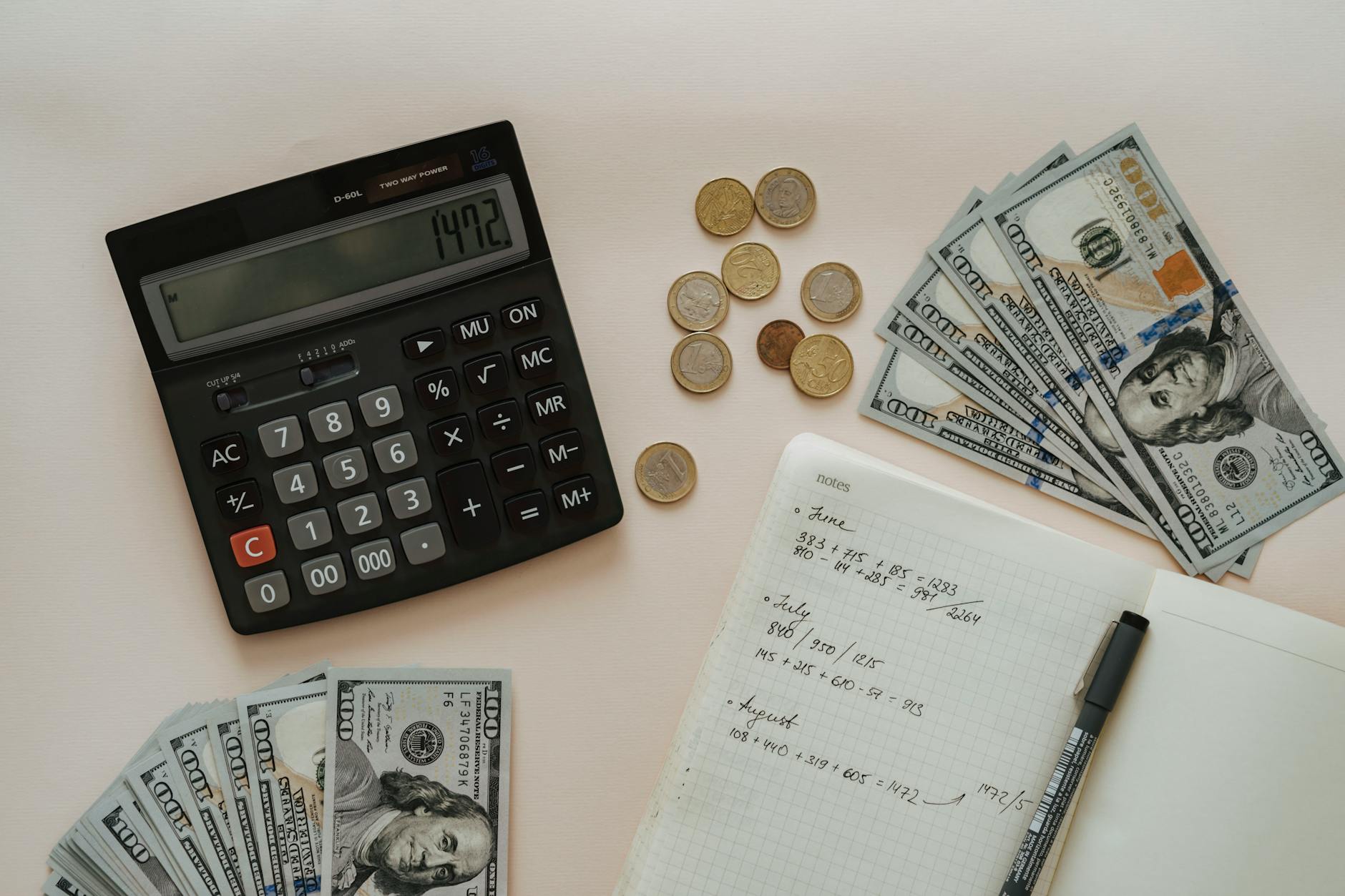

Photo by Kaboompics.com

Understanding your income is a powerful first step into effective budgeting. By calculating your after-tax income and identifying all income sources, you set yourself up for smart financial planning.

Track Your Spending

One of the keys to effective budgeting is understanding where your money goes. By tracking your spending, you gain insights into your financial habits. This awareness can prevent overspending and promote better money management. Here are two powerful methods to track your expenditures: using budgeting apps and maintaining a spending journal.

Use Budgeting Apps

Budgeting apps can simplify tracking your expenses and keeping your finances organized. Many of these apps come equipped with features that can cater to all types of users. Here are a few popular options:

-

You Need a Budget (YNAB): This app promotes a zero-based budgeting approach, encouraging you to allocate every dollar purposefully. It offers robust educational resources, helping you develop better budgeting habits. Learn more about YNAB in this NerdWallet article on budgeting apps.

-

Mint: Known for its user-friendly interface, Mint automatically categorizes your purchases, giving you a real-time view of your spending. This app also tracks your goals over time, providing a measurable way to see progress.

-

PocketGuard: Ideal for beginners, this app helps you understand how much you have left to spend after bills and goals. Its visual indicators make it easy to see where you stand financially.

-

Goodbudget: Utilizing a virtual envelope system, Goodbudget helps you divide your income into budgeting categories. This method visually reinforces your spending limits.

Each app supports iOS and Android devices, making it easy to access your budget anytime. Explore more about these apps and find what works best for your needs.

Maintain a Spending Journal

Keeping a spending journal is another effective way to monitor your expenses. By writing down what you spend daily, you gain insights into your habits and may find areas to improve. Here are some benefits of maintaining such a journal:

- Increased Awareness: Documenting each expense makes you more conscious of your spending patterns.

- Identify Triggers: Note situations that lead to impulse purchases. Are you more likely to overspend when stressed or out with friends?

- Accountability: A journal instills discipline. You’ll think twice before making that unnecessary purchase.

- Financial Goals: Journaling helps set and track your financial goals, creating a clear pathway to success.

To ignite your motivation, consider these compelling resources, like the Benefits of a Spending Diary article. By using a simple notebook, a dedicated app, or a spreadsheet, you can transform your financial future.

Photo by Kaboompics.com

Create a Budget Plan

Creating an effective budget plan is a crucial step towards achieving financial success. Understanding your income, tracking your spending, and methodically organizing your expenses can empower you to take control of your finances. Here’s how to establish a budget plan that works for you.

Choose a Budgeting Method

Selecting a budgeting method that resonates with your financial goals is essential. One widely recommended approach is the 50/30/20 rule, which divides your after-tax income into three categories:

-

50% Needs: Allocate half of your income to essential expenses like housing, utilities, groceries, and transportation. These are non-negotiable costs you must cover every month.

-

30% Wants: This portion covers discretionary spending such as dining out, entertainment, and hobbies. These are expenses you can adjust based on your financial situation.

-

20% Savings: Putting 20% of your income towards savings or debt repayment can set you on the path to financial security.

For more detailed insights about this methodology, you can refer to The 50/30/20 Budget Rule. You can also experiment with a calculator to assess where your finances fall using the NerdWallet Budget Calculator.

Set Up Categories for Expenses

Establishing clear categories for your expenses helps you better manage your budget. Categorizing expenses allows you to see where your money goes and gives you valuable insights for streamlined financial planning. Generally, expenses can be divided into three main categories:

-

Fixed Expenses: These are costs that remain constant each month, such as rent or mortgage payments, insurance premiums, and necessary subscriptions. They are mostly non-negotiable and must be prioritized in your budget.

-

Variable Expenses: These expenses fluctuate in amount and frequency. Examples include groceries, utility bills, and most transportation costs. Understanding these can help you look for ways to cut back when necessary.

-

Discretionary Expenses: These are optional expenses, like dining out, shopping, or entertainment. Cutting back on discretionary spending can help you allocate more toward savings or debt repayment. A detailed look can be found in this resource.

Categorizing your expenses provides clarity and aids in budgeting. By recognizing what's essential versus what can be adjusted, you can tailor your financial plan to fit your lifestyle and goals.

Photo by Joslyn Pickens

Cut Unnecessary Expenses

Lowering spending is a smart move for anyone trying to stretch their budget. You would be surprised at how many expenses can be trimmed. By focusing on non-essential spending and evaluating subscription services, you can find areas for savings that accumulatively make a difference.

Identify Non-Essential Spending

To begin saving money, identifying non-essential spending is key. This involves taking a closer look at your regular expenses and determining what truly adds value to your life. Start by asking yourself a few questions:

- What purchases do I make that I could do without?

- Are there services or products I pay for but rarely use?

- Which items or experiences genuinely bring me joy?

Here are some common areas where you can cut back:

- Dining Out: Try cooking at home more often. Even switching one or two meals a week can help.

- Retail Spending: Assess your clothing, gadgets, or hobby-related expenses. Consider what you can hold off on purchasing.

- Entertainment Costs: Substitute expensive outings with free activities, like movie nights at home or community events.

Keeping a detailed spending log for a month will help you track where your money goes. This information reveals patterns and where you might spend unnecessarily. The more aware you become, the easier it will be to cut back on redundant costs. For effective strategies, visit 12 Ways to Cut Spending and Expenses Effectively.

Consider Subscription Services

Many people don’t realize how much their subscriptions can add up each month. With a myriad of streaming services, gym memberships, magazine subscriptions, and more, you might be paying for things you don't use. It's time to assess each one:

-

List Your Subscriptions: Create a list of all subscriptions you currently pay for. Include everything from magazines to streaming services to app subscriptions.

-

Evaluate Usage: Review how often you actually use these services. Ask yourself:

- Are there several streaming platforms? Can you choose one or two?

- Do you visit the gym enough to justify the monthly fee?

- Have you finished that book you subscribe to?

-

Cancel Unused Subscriptions: If you notice any subscriptions you haven’t touched in months, it's likely time to cancel them. For example, many people have saved money by cutting back on streaming services, as shared in this Reddit discussion on cutting streaming subscriptions.

-

Review Annually: Set a date on your calendar to look at your subscriptions at least once a year. This practice can help keep your budget in check. For a deeper dive into managing subscriptions, check out Best apps to manage your paid subscriptions in 2024.

Photo by olia danilevich

Automate Savings

Automating your savings is a powerful way to help you reach your financial goals while simplifying the process. By setting up systems that move money automatically, you'll work toward growing your savings without putting much thought into it. This strategy can lay the groundwork for a more robust financial future.

Set Up Direct Deposits to Savings Accounts

One of the easiest methods to automate your savings is through direct deposit. This setup allows a portion of your paycheck to go directly into your savings account. You won't notice the difference in your spending habits, making it an effortless approach to build savings over time. Here’s how to get started:

-

Contact Your Employer: Talk to HR or payroll to set up an automatic transfer of your earnings.

-

Choose the Amount: Decide what percentage of your paycheck should be set aside for savings. This amount can be adjusted based on your current budget.

-

Monitor the Process: Ensure that the deposits are being made as planned. Logging into your savings account regularly can motivate you to see your balance grow.

-

Use Multiple Accounts: Consider setting up different savings accounts for specific goals. Whether it's an emergency fund, travel expenses, or a new car, having separate accounts can keep you focused and organized.

For more insights on automating your savings and best practices, explore this article on Bankrate.

Use Round Up Savings Features

Round up savings features available in many financial apps are a fun and simple way to boost your saving habits. These tools take spare change from your purchases and automatically save or invest it. Here’s how they work:

-

Make Small Investments Effortless: For example, if you buy a coffee for $2.70, the app rounds up the charge to $3.00 and saves the extra $0.30. It’s like saving without even thinking about it!

-

Boost Savings App Options: A popular option is Acorns, which not only saves your round-ups but also invests them in a diversified portfolio. For more on this tool, check out the Acorns Round-Ups page.

-

Diversify Your Approach: You might want to explore other apps that offer similar round-up features. This can also involve varying strategies for investing those savings. See which one suits your needs best in this list of round-up apps by Nasdaq.

By implementing automated savings strategies, you can kick-start your financial growth without the hassle. Leveraging direct deposits and round-up saving features will help you watch your savings accumulate effortlessly over time.

Photo by David McBee

Review and Adjust Your Budget

Maintaining an effective budget requires regular reviews and adaptability. By monitoring your finances closely, you can make informed decisions that help you stay on track toward your goals. Regular budget assessments are the backbone of any successful financial strategy.

Monthly Budget Check-Ins

Scheduling regular reviews of your budget can provide clarity and help you stay accountable. Here’s how to integrate monthly check-ins into your financial routine:

-

Set a Fixed Day: Choose a specific day each month to review your budget. Consistency is key. Perhaps the first Sunday or the last Saturday of the month?

-

Gather Your Reports: Collect all relevant financial documents. This includes bank statements, receipts, and your current budget sheet.

-

Analyze Your Income and Expenses: Look for changes in your income and track your spending habits. Did you overspend in any categories? Using resources like NerdWallet's Budgeting Guide can help sharpen your focus.

-

Adjust as Necessary: If some spending categories consistently exceed your budget, it’s time to adjust either the budget or your spending habits. Fine-tuning your budget ensures better adherence.

A monthly budget check-in acts as a financial check-up. It’s a time to reflect and foresee upcoming expenses, making sure incoming and outgoing money aligns with your goals.

Adapt to Changes in Income or Expenses

Life is dynamic, and so should be your budget. Situations that can affect your finances include changing jobs, experiencing a decrease in income, or unexpected expenses like medical bills. Here’s how you can prepare to adjust your budget:

-

Acknowledge Your New Reality: Accept changes gracefully. If income decreases, think constructively about solutions rather than stressing over your past spending.

-

Revise Your Budget Accordingly: Based on your new circumstances, curate a budget that reflects these changes. Resources like this guide on how to adjust your budget offer practical advice for navigating these transitions.

-

Prioritize Essential Expenses: When adjusting your budget, ensures that necessities—housing, groceries, and healthcare—remain at the forefront. Always account for these in your new budget layout.

-

Monitor and Reflect Constantly: Life changes often require ongoing adjustments. Make it a habit to review at least every few months, adapting where necessary to fit your current situation.

Staying flexible and regularly adjusting your budget can ease financial pressures and help maintain stability through unexpected life changes. Managing your finances actively is crucial for long-term success.

Photo by Nataliya Vaitkevich

Stay Motivated

Budgeting isn't just about crunching numbers; it's an emotional journey too. Staying motivated can be challenging, especially when life gets busy or unexpected expenses arise. Here are some effective tips to help maintain your motivation during this important financial endeavor.

Set Financial Goals

Setting clear financial goals can be a powerful motivator in maintaining focus on your budgeting efforts. Both short-term and long-term goals give you something specific to aim for.

-

Short-Term Goals: These might include saving for a vacation or an emergency fund. Define what success looks like and set a timeline. Short-term victories can provide immediate satisfaction.

-

Long-Term Goals: Consider goals like saving for a home or retirement. These goals often require more discipline but remember that every small success adds up. Break them down into actionable steps.

A solid roadmap of goals gives purpose to your budgeting. For more detailed guidance on establishing these financial goals, check out this resource on how to set financial goals.

Celebrate Milestones

Reaching budgeting milestones is a reason to celebrate. Recognizing small wins makes the process feel more rewarding. Here are some ideas:

-

Treat Yourself: When you reach a saving milestone, allow yourself something small, like a favorite meal. These rewards create positive associations with saving.

-

Track Progress: Consider using a visual tracker to mark each milestone. Watching your savings grow can provide motivation to keep going.

-

Share Achievements: Discuss your wins with friends or family. Talking about your goals reinforces your commitment and invites encouragement.

Tracking and celebrating your milestones will help keep your spirits high. For more tips on maintaining your motivation while budgeting, check out this insightful article on 16 surefire ways to stay motivated.

Photo by Shotkit

By setting clear financial goals and celebrating your milestones, you'll build a stronger motivation to stick to your budget. These practices create a cycle of positivity that increases the likelihood of your financial success.

Conclusion

By implementing straightforward budgeting tips, you can transform your financial habits. Start by understanding your income, tracking your daily spending, and categorizing your expenses. Automate your savings to lessen the burden of manual effort.

These steps allow you to gain control over your finances, making it easier to cut unnecessary expenses. Think about your goals—both short and long term—and use them as motivation. Remember to celebrate milestones, no matter how small, as they pave the way for your larger financial successes.

Are you ready to take charge of your budget? Simple adjustments can lead to significant results. Share your journey, and let those around you know about your newfound commitment to financial stability!

Comments

Post a Comment